ACT Resources Cannabis Tax Preparation – February 2020

The first month of 2020 is in the books and you know what that means – tax time is fast approaching! Key due dates for W-2s and 1099s have already passed, placing us in the home stretch. There is still plenty more to be done, especially for businesses in the cannabis industry, which face additional Cannabis Tax Preparation and accounting considerations above and beyond other businesses. This month’s ACT Resources news update is geared towards all the tax and accounting needs for your cannabis business as we head closer and closer to Uncle Sam’s favorite holiday.

Upcoming tax deadlines

January 31 marked one of the first major deadlines in the approach to tax season. Not only were W-2s and 1099 forms due to recipients, it also marked the first day in 2020 that estimated quarterly tax payments were due for applicable businesses. These deadlines are just the first of many upcoming deadlines this year.

The next key date to keep an eye on is February 28, when businesses must submit forms 1099 and 1096 to the U.S. Internal Revenue Service (IRS). Throughout the year there are several other important dates that should be circled on your calendar, including:

- March 16: All S Corps and Partnerships must file or request a six-month extension. S Corps file using Form 1120S, while Partnerships must use Form 1065.

- April 15: Tax Day is the deadline for all individuals and C Corps to file. Individuals use Form 1040, while C Corps use Form 1120.

- September 15: S Corps and Partnerships that were granted a tax extension must file by this deadline.

- October 15: Individuals and C Corps that were granted a tax extension must file by this deadline.

- Form 8300: If your business receives a cash payment of $10,000 or greater, you must file a Form 8300 with the IRS on the 15th day of the month following the cash payment. In the cannabis industry, particularly, dealing with large cash payments is commonplace, so be sure to stay on top of any Form 8300 filings you might be required to make.

Spend the second half of October through the end of the year getting your financial record-keeping in order. You should also run projections to ensure you are on track with all your IRS payments. Preparation is key to missing deadlines and incurring financial penalties, so take the time to plan accordingly.

If you do miss a deadline, you could be required to pay moderate late filing penalties. File and pay as soon as possible to avoid racking up additional penalties. Additionally, as a deadline approaches, you can request a tax extension to give yourself more time to get your documentation in order. When requesting an extension, you are still required to pay an estimate of what you owe; it simply gives you more time to file the appropriate paperwork without penalty.

Keeping all these dates straight can be rather difficult. Luckily, the IRS has provided a tool that is helpful for tracking deadlines. You can download the IRS due date calendar and import it to Microsoft Outlook to keep tabs on upcoming deadlines. Alternatively, you could subscribe to the IRS web calendar, which automatically updates whenever any changes in deadlines occur.

How to streamline tax preparation

Tax preparation can seem like a mountain of work, and it is. However, you can make life easier on yourself by partnering with a third-party payroll service or tax preparer, like ACT Resources. The mantra of tax preparation is “the early bird gets the worm,” so be sure to book an appointment as soon as you are ready to begin the process.

Any tax preparer will have a much easier time helping you in the lead up to your filing deadline if you keep accurate and thorough documentation throughout the year. Many businesses find themselves scrambling at tax time due to simple disorganization. If you keep your books in order, it will be a seamless process for you and your tax preparer to file well ahead of your deadline. Even if you expect your record-keeping is up to par, it pays to take some time between October 15 and the end of the year putting thins in order anyway. Consider it an opportunity to further familiarize yourself with your business’s financial performance.

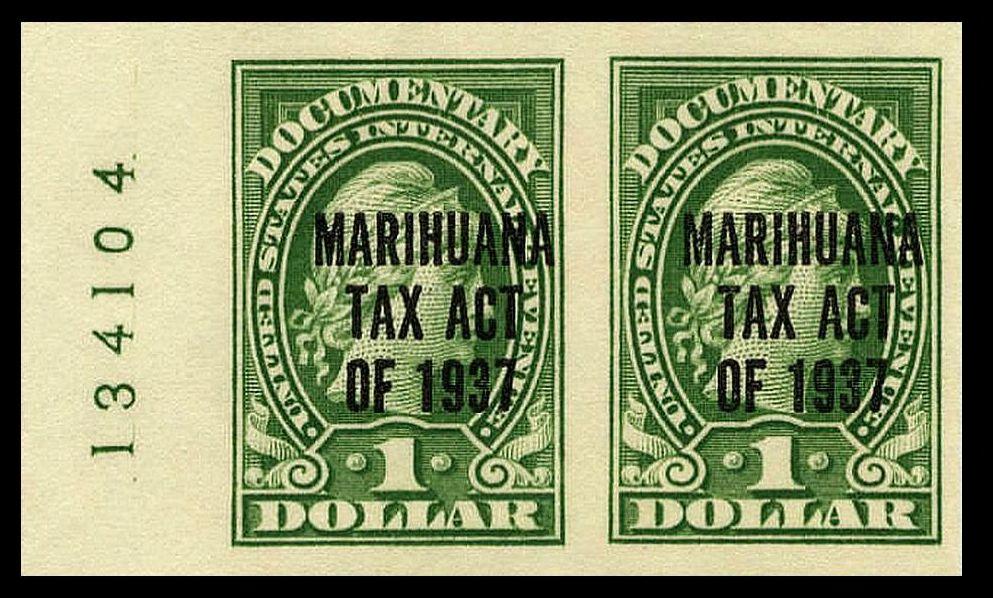

Cannabis-specific tax considerations

The above deadlines and considerations are universal to all businesses, but cannabis businesses must contend with additional rules. For instance, Section 280E of the Internal Revenue Code applies to legal cannabis businesses and prohibits them from deducting ordinary business expenses from gross income. This is because cannabis remains a federally illegal Schedule I substance under the U.S. Controlled Substances Act (CSA). While Section 280E does not require additional action on the part of cannabis businesses or their tax preparers, it is important to be aware that your cannabis business does not qualify for the same tax deductions to which other businesses are accustomed.

Further, cannabis businesses are often subject to state excise taxes, which varies depending on their geographic location. For example, cannabis businesses located in California must collect a 15% excise tax at the point of sale. Oregon levies a 17% excise tax on cannabis sales, while Washington-based cannabis businesses are subject to a 37% excise tax. These state taxes, in addition to any additional local taxes, must be considered throughout the year on top of normal federal tax considerations.

The Secure and Fair Enforcement (SAFE) Banking Act

One of the most anxiously awaited pieces of cannabis legislation in the country is the federal SAFE Banking Act, which made headlines with its overwhelming passage in the House of Representatives last year by a vote of 321 to 103. The SAFE Banking Act would protect financial institutions from potential repercussions of doing business with state-legal cannabis businesses, such as money laundering charges or revocation of FDIC status.

Since its victory in the House, the SAFE Banking Act has sat dormant in the U.S. Senate. Currently, the SAFE Banking Act is awaiting action before the Senate Banking Committee. In December, Senate Banking Committee Chairman Sen. Mike Crapo (R-ID) indicated his opposition to the bill. However, several House co-sponsors of the legislation recently sent a letter to Crapo urging him to advance the legislation to “[bring] businesses out of the shadows and into the well-regulated banking system.”

The SAFE Banking Act has made it further in the federal legislative process than any other legal cannabis-related bill to date. However, it appears stalled in Senate committee for now, and it is unclear if it will progress any farther.

Tax season is a hectic time for any business, but cannabis businesses especially must pay close attention to their financial record-keeping. Not only is prohibition alive and well at the federal level, making cannabis businesses easy targets, the additional hoops cannabis businesses have to jump through means additional planning throughout the year. Staying organized and partnering with a knowledgeable and experience professional accountant is the key to a quick and painless tax season, year after year. At ACT Resources, we don’t just know taxes and finances, we also know the cannabis industry. If you’re ready to partner with an accountant that has your unique needs at heart and will help you prepare financially for the future of the cannabis industry, don’t wait – ACT today!